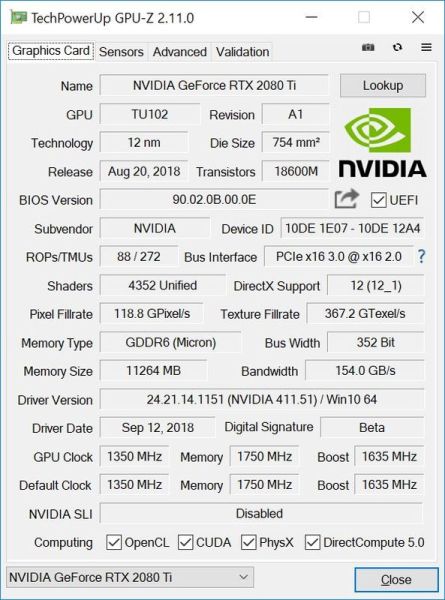

When NVIDIA made its new GeForce RTX series graphics card official, it launched not one, but three different cards for three totally different SKUs. Of the three, the GeForce RTX 2080 Ti is the brand’s latest king of the polygonal hill.

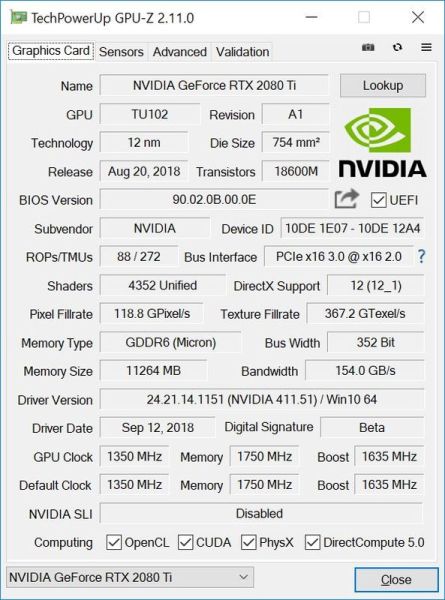

With the card having arrived in our hands, we set out to answer the same old question for every new generation of graphics cards that pops up: How powerful is the card’s new Turing GPU? More importantly, how much more powerful is it compared to its predecessor?

Design

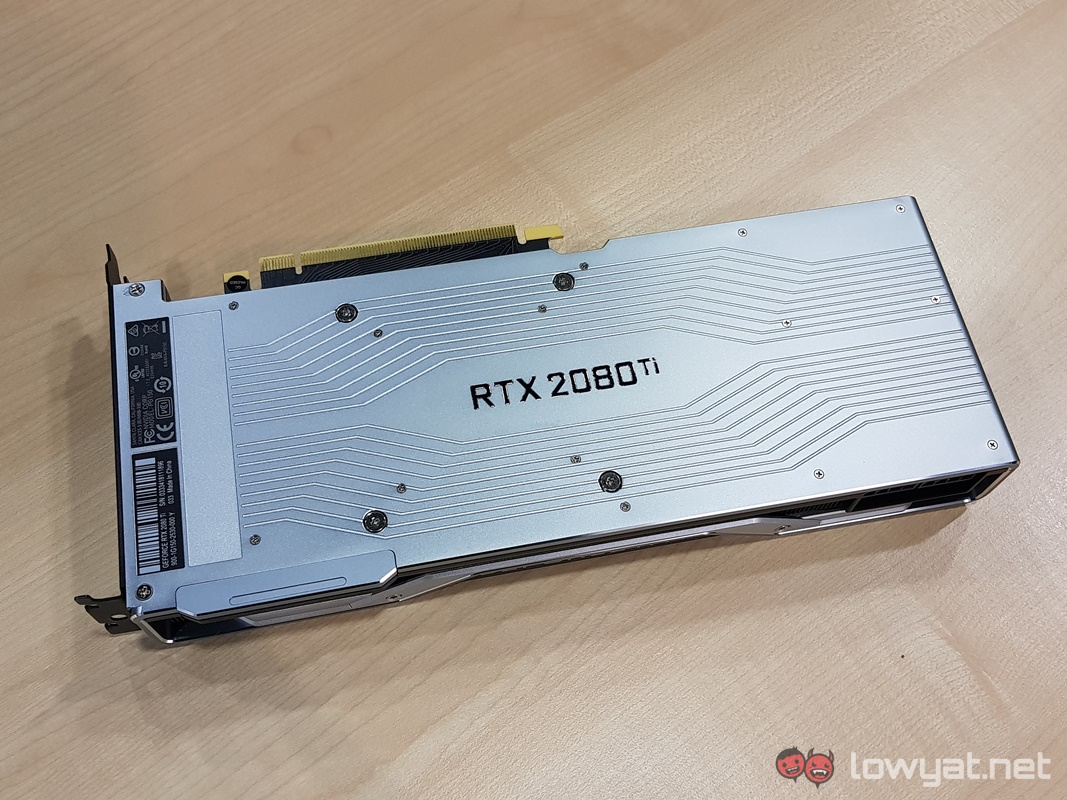

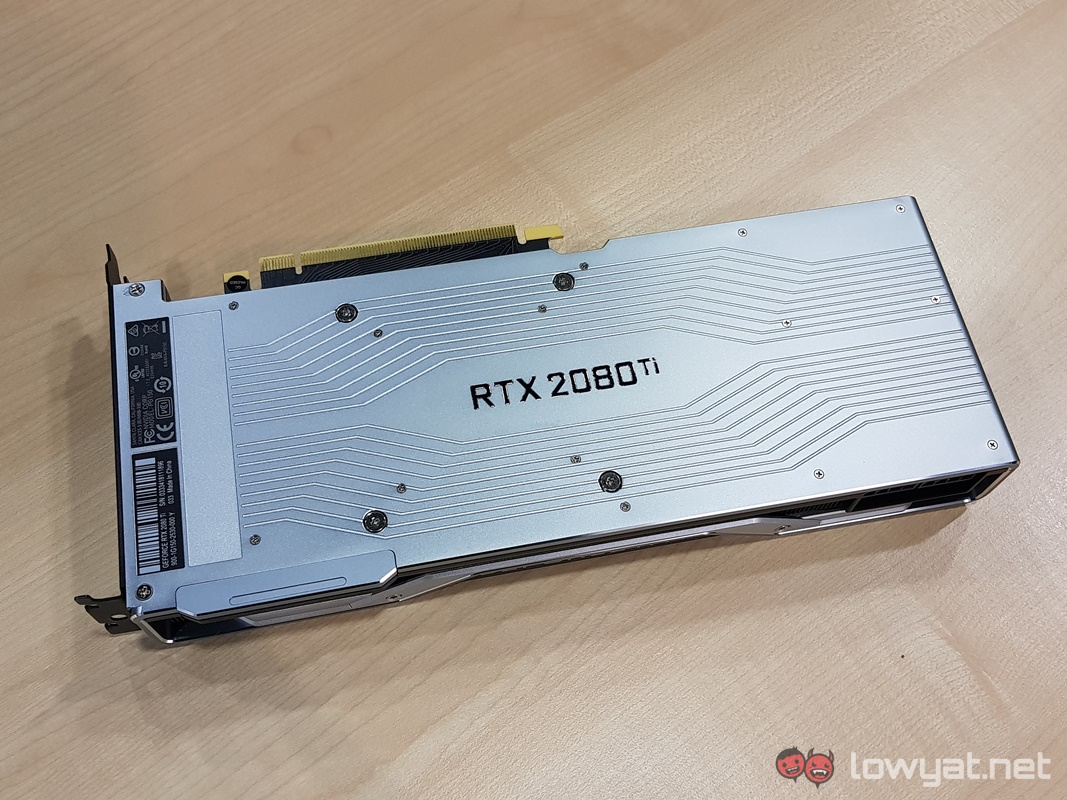

As many of you may notice, the cooler shroud on the GeForce RTX 2080 Ti isn’t the same single-fan, blower style cooling solution that NVIDIA has used with many of its graphics cards of yore. What greets PC owners (who are fortunate enough to own a Founders Edition of the GeForce RTX series cards) is a dual-fan solution that still retains the blower style, rear exhaust design.

Gone are the angular cuts that the GTX 10 series cooler shrouds used to employ. In its place, the card sports a clean, simple, and dusted metallic design at front. On that note, even the card’s backplate looks a little more intricate; NVIDIA has gone with a silver design over the black motif that its predecessor used. With the card’s name emblazoned right in the middle.

Ports-wise, the card sports three DisplayPort 1.4 ports, 1 HDMI 2.0b port, and and USB Type-C port for DisplayLink. Because of the high-performance nature of the RTX 2080 Ti, the card doesn’t come with a dual-link DVI port. Just as well too, considering that this is a card designed for the big boys.

One last thing; the RTX 2080 Ti is one of the only two variants in the RTX series to use an NVLink bridge for multi-GPU configuration. Versus the previous SLI bridge used with all other GeForce cards before it.

Test Machine Specs

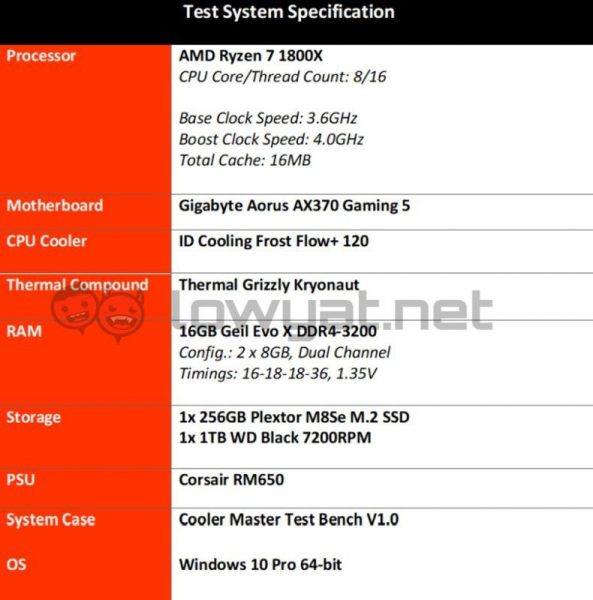

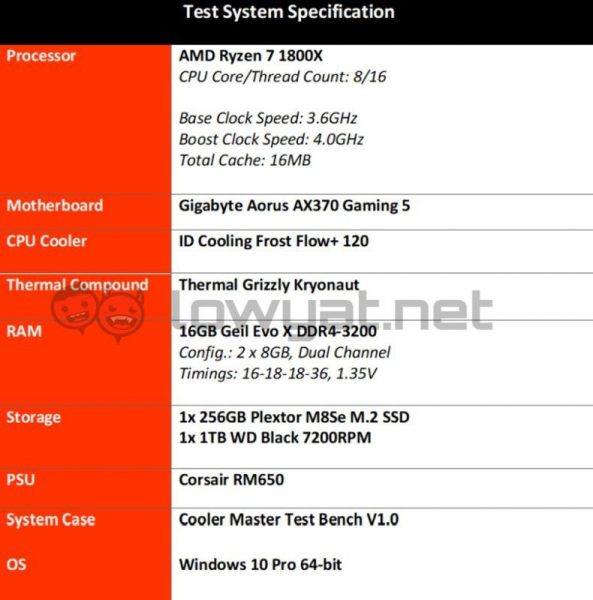

It should be noted that the monitor we used to test out the card was the ASUS ROG Swift PG27UQ 4K HDR monitor. It’s a fitting choice, considering that NVIDIA is touting the card as being able to run games and other media content at resolution, and with HDR activated to boot.

At this point, we should probably explain why it is we’re we’re testing the RTX 2080 Ti using an AMD Ryzen 7 1800X CPU instead of the latest Intel CPU with a Z370 or Z390 system. This is because, at the time of testing, it was the most up-to-date test bed which the assigned had.

That’s not to say the end results gained from an RTX 2080 Ti tested on an AMD Ryzen testbed is bad. If anything, it’s a fresh perspective to see how the card handles itself on such a system. Of course, we will update this article with benchmarks from an Intel-based test bed, provided we do get one in the future.

Benchmarks

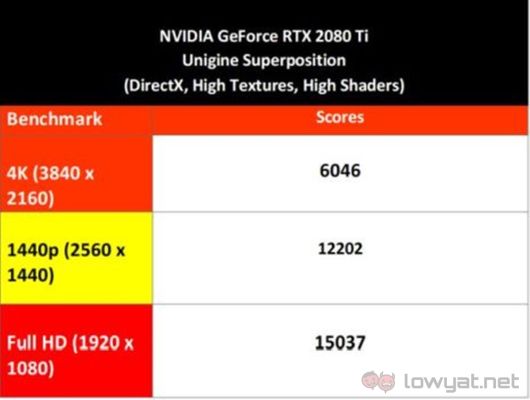

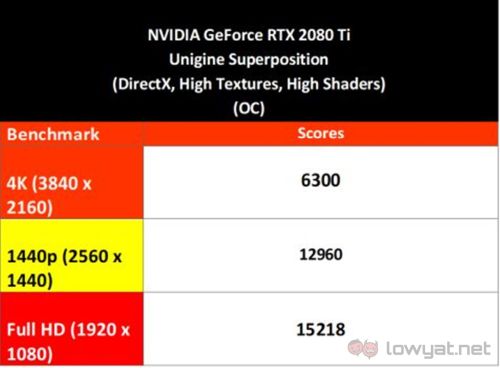

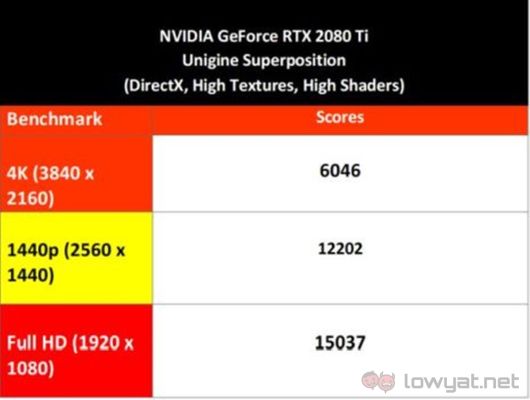

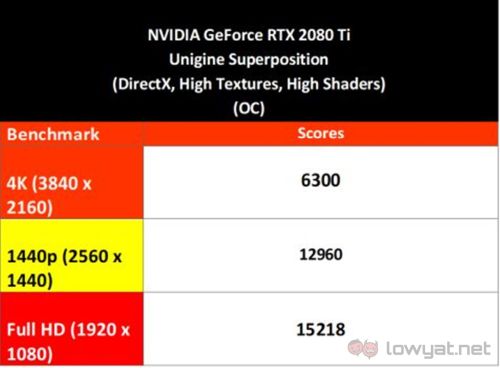

As you would expect of NVIDIA’s new king of the hill, the card actually performed pretty well in the synthetic benchmarks. Especially with benchmark tests ran in 4K and 1440p resolution.

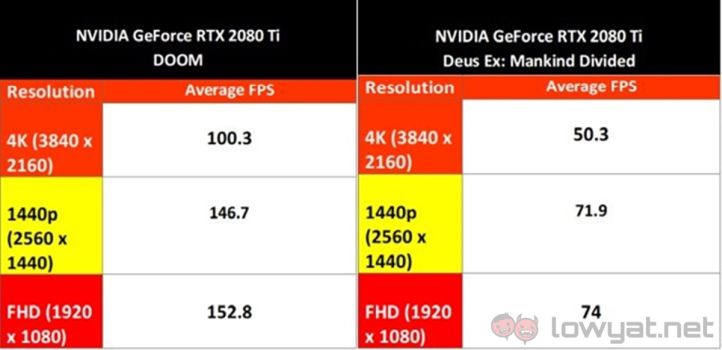

Naturally, the card wasn’t without its hurdles and caveats, and those issues reared their ugly heads when we put the card through three of (what we decided to be) the most graphically demanding titles to date. These titles were Deus Ex: Mankind Divided, Doom, and the recently released Shadow of the Tomb Raider.

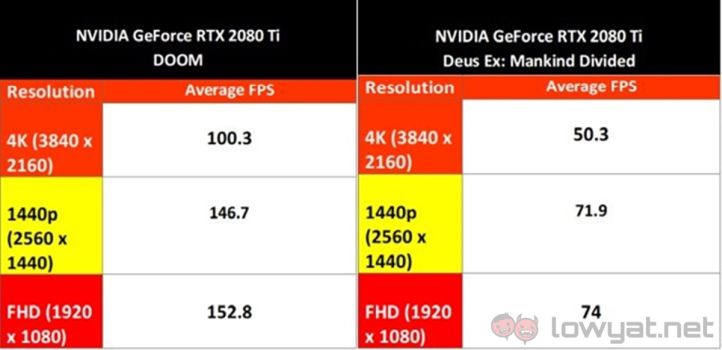

Of the three titles, Deus Ex: Mankind Divided was by far the most taxing for the RTX 2080 Ti. At the game’s highest graphics setting at 4K resolution, the card was genuinely struggling keep the average framerates above 50 fps, let alone 60 fps.

At 1440p, the framerates was naturally a more familiar story for the card. At this resolution, the RTX 2080 Ti was achieving framerates beyond 100 fps, before averaging out at the 72 fps mark.

Needless to say, the card’s performance on Doom was unprecedented. At both 4K and 1440p resolution, the card barely broke a sweat. Maintaining high average framerates well above the 100 fps mark, even with the heavy presence of in-game particles brought on by the game’s Nightmare setting. If anything, we’d say the card was cackling at the game.

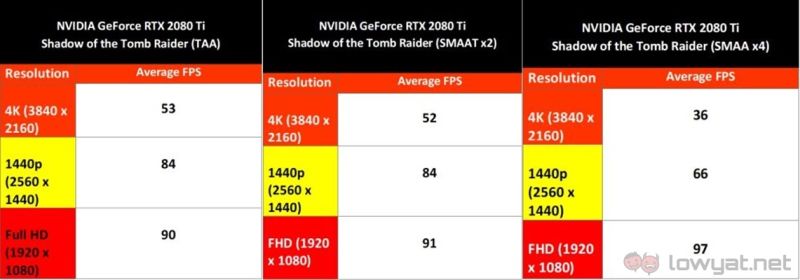

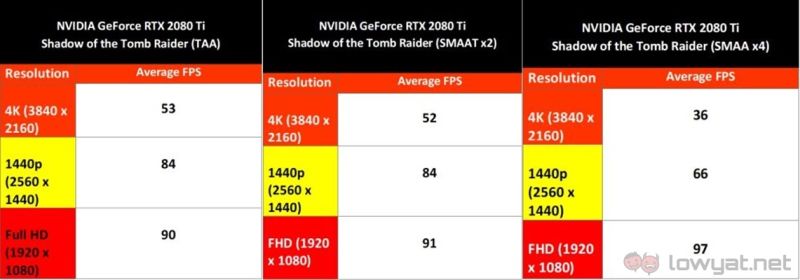

We took a slightly deviated approach with Shadow of the Tomb Raider, running the three highest anti-aliasing settings – TAA, SMAAT x2, and SMAA x4. At TAA and SMAAT x2, the RTX 2080 TI produced similar results across 4K and 1440p resolutions.

When we cranked it up to SMAA x4, it became very apparent that the card was struggling to keep its composure at 4K resolution. To be precise, the card began showing some stuttering effects caused by graphical lag during the Paititi portion of the game’s benchmark.

Overclock

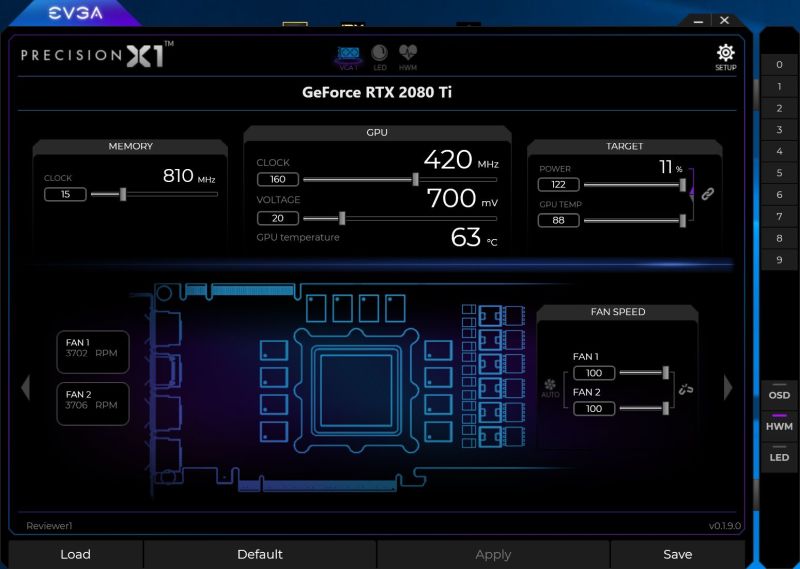

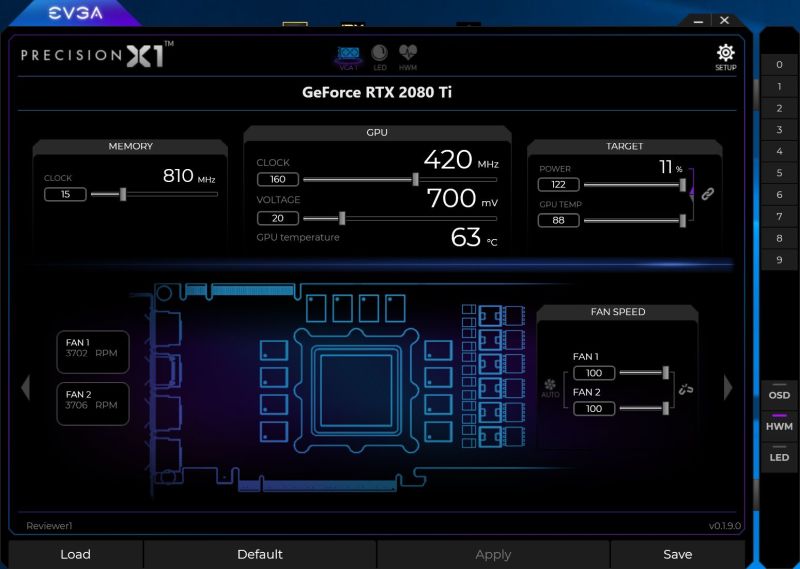

Overclocking the card was – as these things usually go – a relatively straightforward process. However, instead of MSI’s Afterburner OC Tool, we decided to use the new Precision OC Tool that was provided to us by NVIDIA. Do note that the tool was still in beta, but to its credit, we didn’t encounter any issues while using it to push the RTX 2080 Ti as hard as we could.

In regards to the numbers, we only managed to overclock the RTX 2080 Ti by an additional 160MHz on the GPU and 90MHz (15MHz x4) with its memory. We also managed to crank up the GPU Core Voltage by an additional 30mV, though there were times that we were able to reach 50mV via the OC tool.

While the RTX 2080 Ti showed some significant performance improvements with the synthetic benchmarks, the same cannot really be said for the gaming portion of the tests. In Shadow of the Tomb Raider, the card only showed a minor increase of 5-7 fps. This trend was consistent in all three AA modes.

DOOM was practically the only title that showed signs of a marked improvement with an increase of nearly 10 fps in 4K, 14 fps in 1440p, and 22 fps in Full HD.

Power Consumption And Thermals

Compared to the GeForce GTX 1080 Ti, the RTX 2080 Ti surprisingly requires a tad bit more power to function efficiently. To that end, the card actually requires two 8-pin PCIe power ports to run.

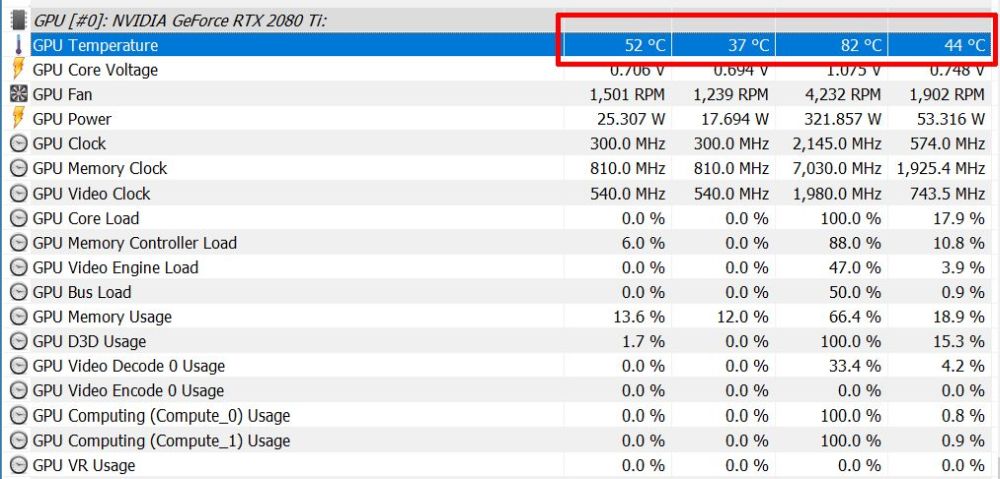

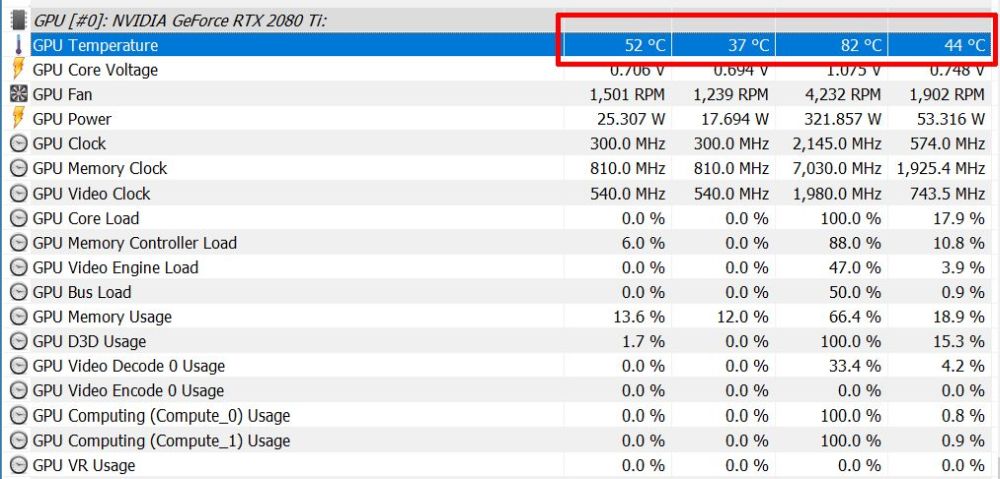

Out of the box, the RTX 2080 Ti had an average temperature reading between 44°C and 52°C. When idle, the card’s temperature hovered around the 37°C mark, and peaked at 82°C on a full load. By comparison, that’s a 9°C difference between the RTX 2080 Ti and the GTX 1080 Ti. On top of that, that’s with a dual-fan cooling solution too.

Surprisingly, the RTX 2080 Ti’s temperatures showed minimal differences when we overclocked it. We did, however, notice a moment when the card spiked to 88°C and maintained that temperature for a period of no longer than 15 minutes.

In terms of power consumption, the RTX 2080 Ti idled below the 90W mark when we left the PC turned on but doing nothing. When put to work, the card (along with the system) pulls an average of 421.7W on a full load. Upon overclocking it, that number (obviously) increased, and even surpassed the 450W threshold, and hovered around 474W.

Conclusion

While the Founders Edition of the GeForce RTX 2080 Ti won’t be coming to Malaysia (at least, not through legal channels) anytime soon, there isn’t a shadow of a doubt that this card was designed to go hand-in-hand with a top-tier, decked out PC. However, if you’re already an owner of last year’s top-of-the-line GTX 1080 Ti, we can only imagine you trading up for the RTX 2080 Ti for a couple of reasons.

The first reason would be bragging rights. As it stands, there isn’t anything more powerful than this card on the current market. The second reason would be to gain access to the new RTX feature that- as its namesake suggests – adds real-time ray-tracing to games. However, the availability of this feature is dependable on Microsoft officially rolling out the DXR patch, as well as game developers patching their game accordingly.

That said, the card is still a definitive step up for gamers, especially for gamers who can afford the over RM5000 asking price of all the custom cooled RTX 2080 Ti cards that are currently on sale in Malaysia.

The post NVIDIA GeForce RTX 2080 Ti Founders Edition Review: Meet The New 4K HDR King appeared first on Lowyat.NET.

from Lowyat.NET https://ift.tt/2P32csP

Labels: Lowyat

The 50th Civil Affairs Division of the Seoul Central District Court has ruled in favor of cryptocurrency exchange Coinis against Nonghyup Bank, local media reported.

The 50th Civil Affairs Division of the Seoul Central District Court has ruled in favor of cryptocurrency exchange Coinis against Nonghyup Bank, local media reported. Kim Tae-lim, a lawyer connected to the case, explained that Nonghyup Bank breached the contract with Coinis since the exchange “has the right to freely deposit and withdraw money in the account in accordance with the deposit agreement entered into between the bank and the exchange,” the Digital Daily detailed. Kim was further quoted by the publication:

Kim Tae-lim, a lawyer connected to the case, explained that Nonghyup Bank breached the contract with Coinis since the exchange “has the right to freely deposit and withdraw money in the account in accordance with the deposit agreement entered into between the bank and the exchange,” the Digital Daily detailed. Kim was further quoted by the publication: However, only four exchanges in the country are using the system: Bithumb, Upbit, Coinone, and Korbit. Banks have refused to provide the real-name conversion service to the rest of the exchanges. Coinis, therefore, continued to use its corporate account to accept customer funds. Banks claim that crypto exchanges that are not using real-name accounts are at high risk of money laundering.

However, only four exchanges in the country are using the system: Bithumb, Upbit, Coinone, and Korbit. Banks have refused to provide the real-name conversion service to the rest of the exchanges. Coinis, therefore, continued to use its corporate account to accept customer funds. Banks claim that crypto exchanges that are not using real-name accounts are at high risk of money laundering.

Binancecoin (BNB) has been listed on

Binancecoin (BNB) has been listed on  It has been revealed that on Oct. 25 Binance froze more than 93,000 ETH that had been transferred from the embattled Wex exchange, valued at $18.5 million.

It has been revealed that on Oct. 25 Binance froze more than 93,000 ETH that had been transferred from the embattled Wex exchange, valued at $18.5 million. Bittrex has announced that it will launch

Bittrex has announced that it will launch  Chris Lee, the former chief executive officer of Okex and the current board secretary and vice president of global business development for Huobi, has stated his expectation that security token offerings (STOs) will become a “mainstream fundraising method” in approximately three to four years.

Chris Lee, the former chief executive officer of Okex and the current board secretary and vice president of global business development for Huobi, has stated his expectation that security token offerings (STOs) will become a “mainstream fundraising method” in approximately three to four years.

In the last

In the last  XRP

XRP

The declining trading volume across many leading markets saw several cryptocurrencies sneak into the top 20 rankings for the first time in recent months. ZB, for example, ranked 17th with a 30-day trade volume of $1.16 billion, following by

The declining trading volume across many leading markets saw several cryptocurrencies sneak into the top 20 rankings for the first time in recent months. ZB, for example, ranked 17th with a 30-day trade volume of $1.16 billion, following by