Gold and Bitcoin Markets Tested, While Central Banks Try to Quell Stock Market Rout

Central banks worldwide have been bracing for the worst, as the global economy has shuddered over the last seven days. On March 11, the Bank of England slashed rates by 50 bps bringing the base rate down to 0.25%. Meanwhile, Wall Street bankers and U.S. President Donald Trump want the Federal Reserve to slash rates even more and a few speculators expect a 100 bps rate drop by next week. As central banks are being accused of depleting their monetary policy tools prematurely, on March 12, European Central Bank President Christine Lagarde decided not to cut rates. Gold and crypto prices have also been under intense pressure for four consecutive days.

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Stocks Plunge, Bank of England Slashes Rates, ECB’s Lagarde Holds Back

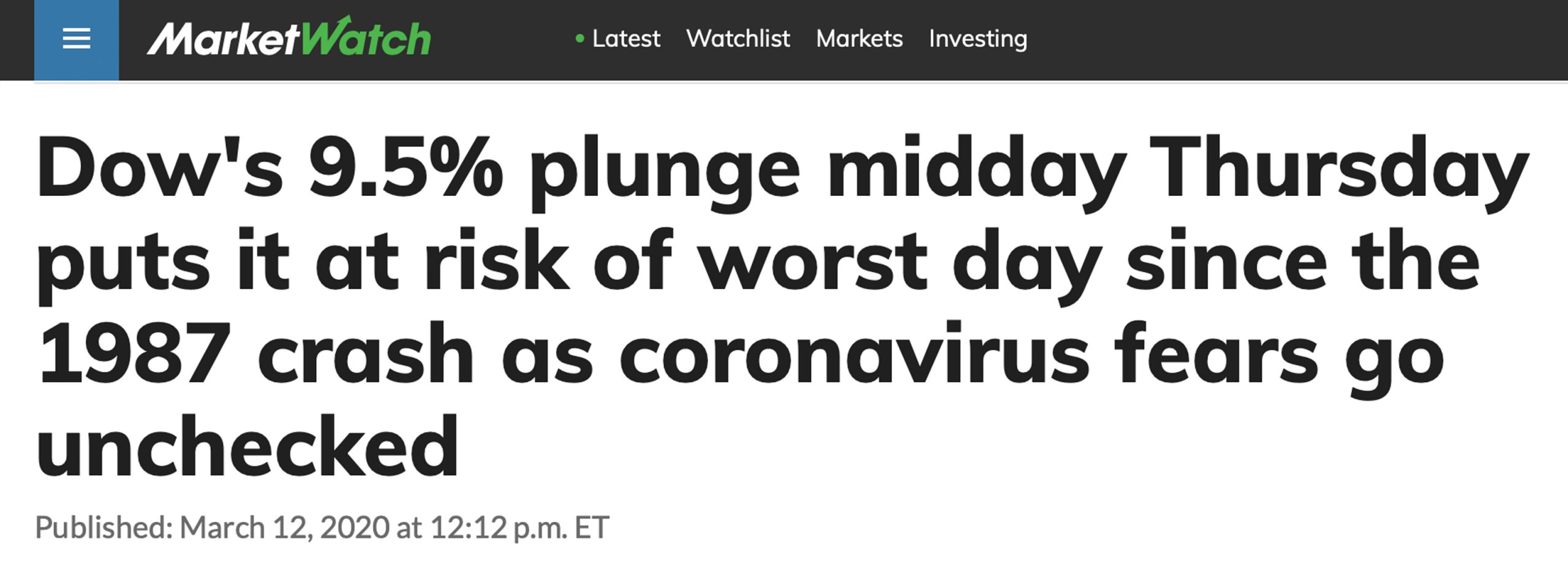

It’s been a bad week for global markets, as the coronavirus outbreak has created a lot of fear and panic selling. On Thursday, March 12 the top three stock indexes in the U.S. have lost considerable value and British, European and Asian markets have felt the brunt of the economic storm.

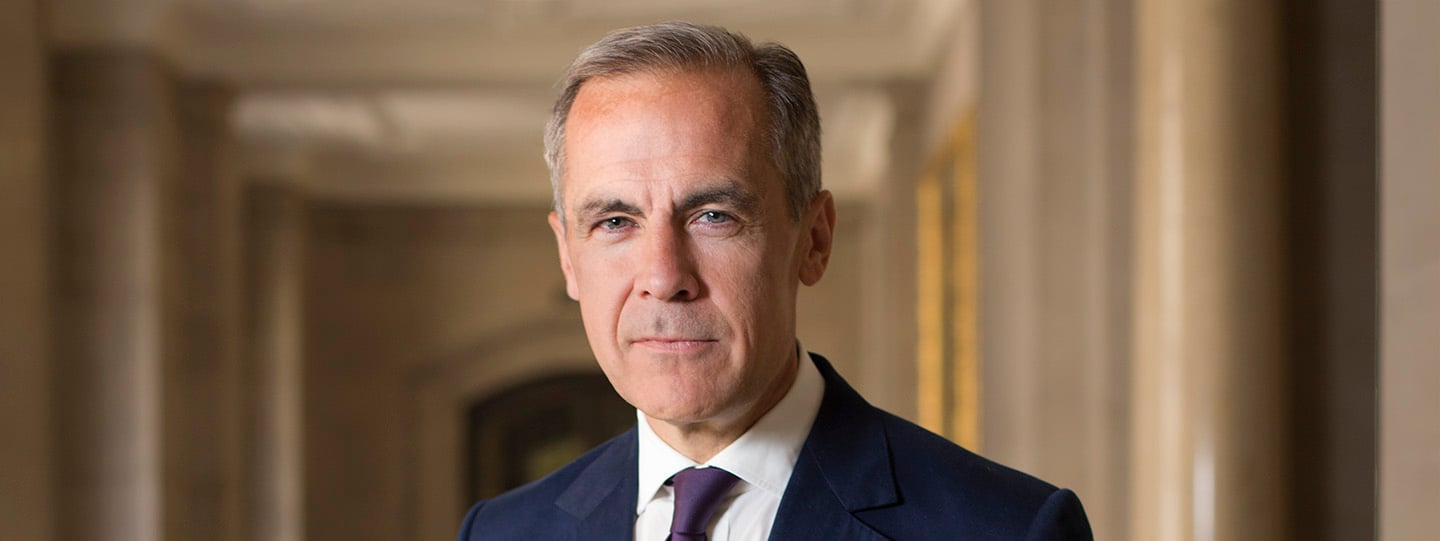

The Dow Jones Industrial Average is down over 2,300 points at press time suffering the worst decline since 1987. The day prior, on Wednesday, the Bank of England (BoE) decided to follow the Federal Reserve’s move and cut the base interest rate by 50 bps. The bank now has a rate of 0.25% and immediately after the rate cut, the British pound took a hit against the U.S. dollar.

The market reaction was similar to the effect the Fed rate cut had on U.S. markets the week prior. The next day on Thursday, the European Central Bank decided to address the public and detailed that the bank would offer cheap loans to banks as a form of stimulus. However, unlike the Fed and BoE, European Central Bank (ECB) President Christine Lagarde decided not to cut rates.

It’s possible the ECB held back because of the adverse effects the rate cuts had in the U.S. and the U.K. Various economists also believe central banks are simply running out of monetary policy. Wall Street economist Henry Kaufman, who earned the name “Dr. Doom,” told the press he believes central banks are running out of ammunition to confront a deep recession. The 92-year old former Salomon Brothers economist is well known for predicting economic events throughout the ‘70s and ‘80s. Kaufman disclosed that the recent rate cuts executed by the Fed and the BoE “won’t address a crisis.”

How long until The Fed is literally printing toilet paper to help alleviate the crisis?

— Erik Voorhees (@ErikVoorhees) March 12, 2020

Meanwhile, at the same time, U.S. President Trump called the Fed’s recent move “pathetic” and further tweeted that the central bank could do better. “Our pathetic, slow moving Federal Reserve, headed by Jay Powell, who raised rates too fast and lowered too late, should get our Fed Rate down to the levels of our competitor nations,” Trump tweeted. “They now have as much as a two-point advantage, with even bigger currency help. Also, stimulate.”

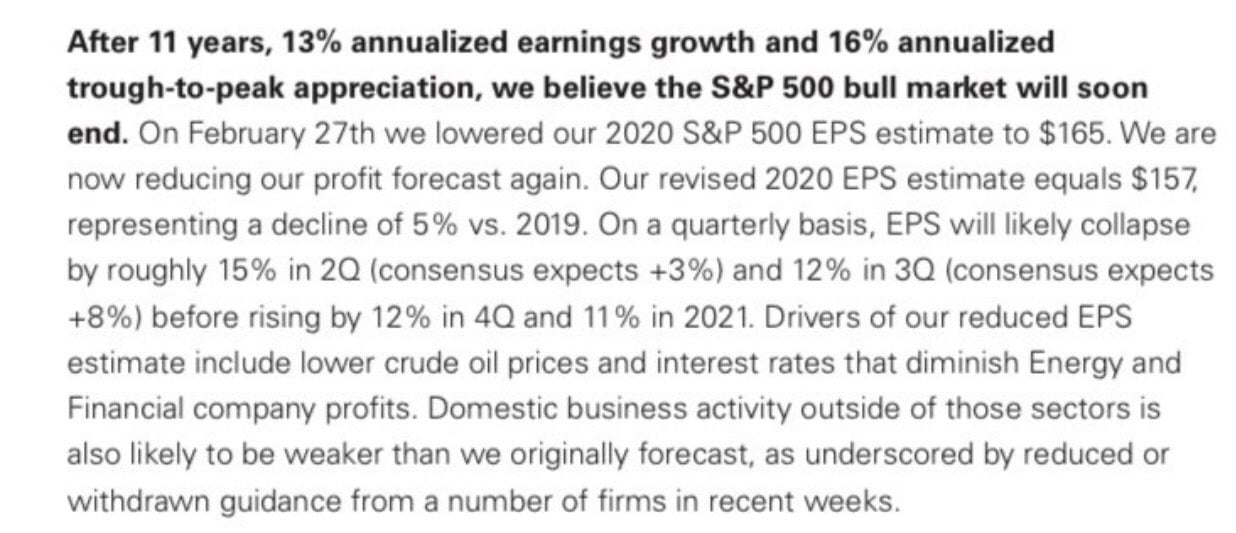

Goldman Sachs Predicts the Fed Will Cut Rates by 100 bps and the End of S&P’s Bull Market, PBoC Rate Cuts, Italian Mortgage Industry Suspended

Further, mega bank Goldman Sachs sees the Fed cutting rates back by 100 basis points soon. Goldman also recently noted that they expect the “S&P bull market to end soon” after 11 years. In Italy, where the coronavirus outbreak has locked down the entire country, deputy economy minister Laura Castelli told BBC reporters that mortgage payments will be suspended across Italy. China’s central bank plans to cut rates soon as well Ting Lu, chief China economist at Nomura told investors on Thursday. “Without exception, these calls by the Premier will be implemented by the (People’s Bank of China) almost immediately, so we expect the PBoC to announce a targeted RRR cut in the next few days, possibly before or over the coming weekend,” the Nomura economist noted.

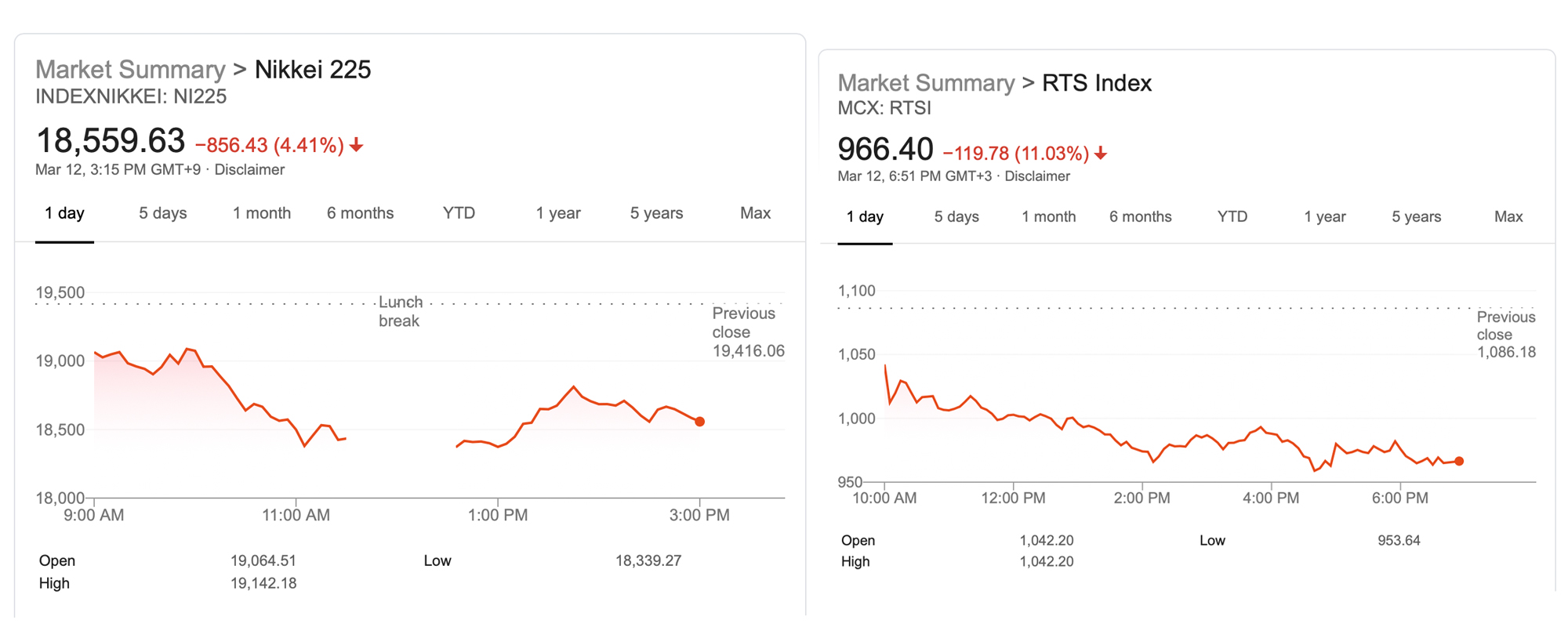

Japanese and Russian Stocks Feel the Wrath

The Japanese economy has been feeling the pressure of inflation and the economic effects of the virus spread as well. Reports note that Japanese bureaucrats are pushing the Bank of Japan (BoJ) to cut rates more and increase stimulus but policy options have become limited. Just like a number of central banks during the second half of 2019, the BoJ board members introduced a significant number of monetary easing policies.

Tokyo’s financial markets saw considerable losses all week, as Japan deals with escalating coronavirus fears. On Monday, the Nikkei index ended at a 14-month low with numbers not seen since 2016. Following Trump’s travel ban between the U.S. and Europe, the Russian stock market and the ruble also dropped exponentially. The ruble was shaved 4% against the U.S. dollar and the Moex Index fell by 6%. Russia’s RTS Index slipped by 1,000 points, to the lowest levels in two years.

Boeing is probably going to be one of the first "too big to fail" corporations that will require us to embrace corporate socialism with a bailout. It will be presented as an "emergency" and it will be 100% bipartisan.

The bailouts are coming again. They won't come for you.

— Andreas ☮ 🌈 ⚛ ⚖ 🌐 📡 📖 📹 🔑 🛩 (@aantonop) March 12, 2020

Is Bitcoin a Risk Asset or Store of Value During Economic Uncertainty?

Throughout all the madness, the overall cryptocurrency market cap of over 5,000+ coins lost $50 billion in three days. BTC prices plunged over 20% in a 24 hour period and went below the $6K mark on March 12. The fall from the $9,100 range to under $6K in just a few days time has called into question the reliability of those who believe BTC is a store of value (SoV).

The SoV debate has been trending on social media and crypto-related forums over the last few days and SoV evangelists have been quieter. “So much for bitcoin being a safe store of value,” tweeted David Pinski. “Looks like fiat denominated hard currencies are still king. Even with the crypto set. Scratch that hypothesis,” Pinski added. “Cash looks like the safe haven today,” the Twitter account Moneypages wrote. “Gold down ~5%, Bitcoin down ~22%. This will be a test for cryptos and their claim to be a store of value.”

I'm buying. This is why bitcoin was invented

— Barry Silbert (@barrysilbert) March 12, 2020

Surely enough, a good number of people believe that the current economic storm will be a true test for bitcoin. “Want to know what the stock market would look like without down limits and circuit breakers and closing bells? Go look at bitcoin right now,” tweeted the Wall Street Journal author Paul Vigna on Thursday. One person asked Vigna if he thought it was of “any interest that crypto markets are aligning with traditional markets is interesting, even if exaggerated?” Vigna responded:

If bitcoin was really aligned [with] traditional markets, it would have sold off like this much sooner. As the riskiest asset, bitcoin would’ve been the first to go. Just my opinion.

Other people sincerely believe BTC is the best store of value and despite the price setback, it is still doing remarkably well. “If you had bought bitcoin exactly 1 year ago at a price of $3.779 you would be up 96% in dollars,” Crypto Mad Max tweeted. “Bitcoin is a store of value, with huge ups and downs from time to time look at the bigger picture,” Max added.

Former Mega Upload CEO, Kim Dotcom explained that he believes cryptocurrencies need more users as opposed to a slew of speculators. “Institutional investors are dropping out of Bitcoin. That’s good. Crypto needs more users, not more speculators. Mass utilization is accelerated by the economic crash. But Crypto needs more easy-to-use & secure apps allowing users to pay for real things in real-time at low fees,” Dotcom said on Thursday.

It’s proven beyond doubt now that Bitcoin is not a gold-like hedge, but a high risk asset class that’s first in line to be sold even before normal stocks. The “store of value” side is now completely debunked in addition to the “everyone needs to run a non-mining full node” side.

— Olivier Janssens🎗 (@olivierjanss) March 12, 2020

Gold Doesn’t Hold – Prices Slide Below $1,600 Range

Meanwhile, gold saw a quick rise during the early morning hours on March 12, but prices dropped $50 at 2:30 EST. One ounce of fine gold dropped below the $1,600 per ounce region to $1,589 but jumped back above the psychological $1,600 zone shortly after. At 4 p.m. EST, gold dipped again and touched a low of $1,570 per ounce and has been hovering around that region for roughly an hour at time of writing.

During the last few weeks, the whole world has been on edge from the coronavirus outbreak and the economic calamity that has followed. Throughout all of the mess, it is clear that crypto markets are facing the unknown as the economy was doing well since the 2008 crash. Bitcoin itself was born from the flames of the economic meltdown in 2008, but it has never experienced a full-blown recession.

Right now the world’s central banks in the EU, U.K., Asia, U.S., the Middle East, and Latin America are trying to ease the situation with monetary policy and stimulus. The Federal Reserve told the public it will inject $1.5 trillion into the hands of private banks on Thursday. Using the stimulus, the Fed plans to purchase Treasury Inflation-Protected Securities, notes, and bills “across a range of maturities.” It’s pretty clear what the central banks will do to try and circumvent an economic disaster, but people now wonder how cryptocurrencies will react to the possibility of financial collapse.

What do you think about the central banks and how they have been reacting with stimulus and rate cuts to battle the coronavirus’s effect on the global economy? What do you think of the ECB holding back on cutting rates for now? Do you think that cryptocurrencies like bitcoin will act as a store of value through these uncertain times? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, Twitter, Trading View, Google Stocks, Twitter, Goldman Sachs, Market Watch, Fair Use, and Pixabay.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Gold and Bitcoin Markets Tested, While Central Banks Try to Quell Stock Market Rout appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/39Nf50E

Labels: Bitcoin

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home