Scammers On The Prowl; How To Spot a Scam & What You Should Do

The COVID-19 pandemic needs no further introduction. Sadly, it’s not the only threat that exists at this current time as there are others out there also preying on unsuspecting individuals. Unlike the coronavirus, this other threat is very much human.

Scammers, as you know them, are individuals who take advantage of certain situations in order to profit from people like you and me. Their trade is basically having nothing to trade at all for usually a large sum of money. Of course, they won’t tell you that and will usually cover up their sham with lies.

For victims who are in states of fear or panic, this deception is often blurred and would affect their decision-making. Especially when you have a pandemic on hand, where most people are seeking some form of insurance to secure their own wellbeing or their finances. Scammers often use this situation and disguise themselves as banks or certain organisations to approach these victims in order to take advantage.

The scammers may contact individuals randomly, but their modus operandi are pretty much similar every time. Being aware of their characteristics and methods works well as a form of countermeasure or prevention, so it’s vital for you to first identify if you are being approached by scammers.

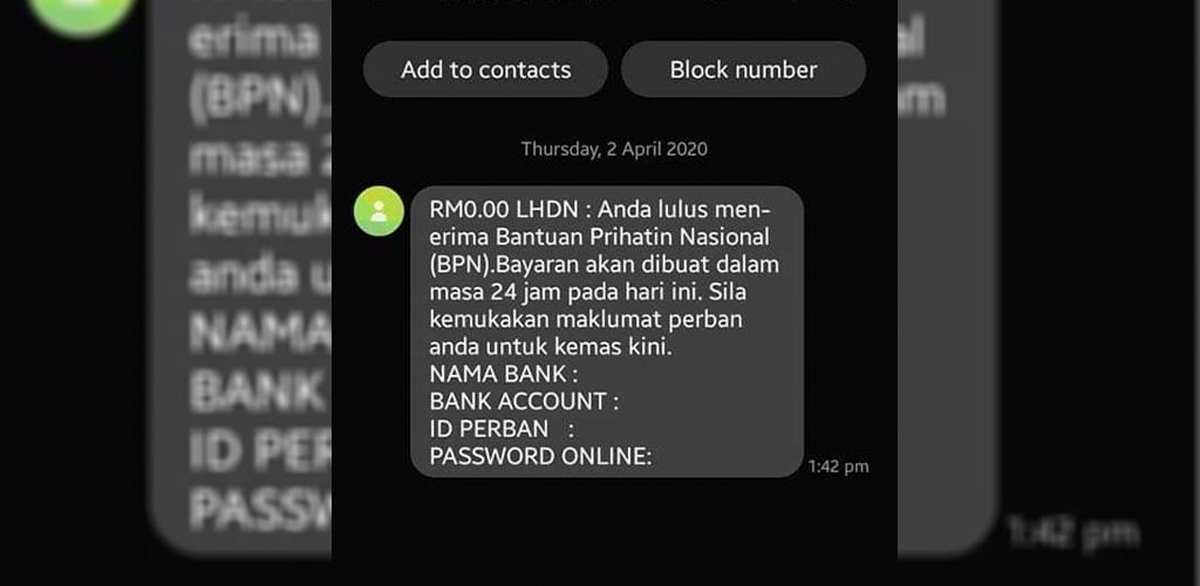

Fake Bantuan Prihatin Nasional (BPN) Scams

As announced by the government, the BPN relief is issued to Malaysians who are affected by the COVID-19 pandemic. BPN provides individuals and businesses with financial aid, with the aim of easing their burden as shops and workplaces are forced to close during the Movement Control Order (MCO) period.

Scammers take advantage of this situation by often disguising themselves as the Inland Revenue Board (LHDN) to approach victims, usually via SMS. They would deceive victims by asking them to provide personal details such as their bank ID and password, often disguising their scam as a method for victims to apply for BPN or to check if they are eligible for the financial aid.

The obvious tell to whether the SMS is a fraud or not is by referring to the phone number used. LHDN will contact individuals with government-designated numbers, while scammers use regular mobile phone numbers. Importantly, the organisation will never ask for anyone’s personal details.

Fake Loans or Banking Scams

Scammers would normally disguise as a bank staff and approach victims to provide income documents on the pretext of offering a personal loan for a fee (eg.Processing Fees and Insurance / takaful coverage) but will not request the victim to provide online banking information or their credit / debit card details as mentioned below.

Some have reported that these bogus SMS would also include a bit.ly link, which would initiate a personal WhatsApp chat with a “customer service operator” for immediate “enquiries.” From there, their goal is the same but this time around with a one-to-one “advisory” role to further deceive their victims.

The more daring sort of scammers would even go as far as calling their victims directly. Again, disguising themselves as bank representatives.

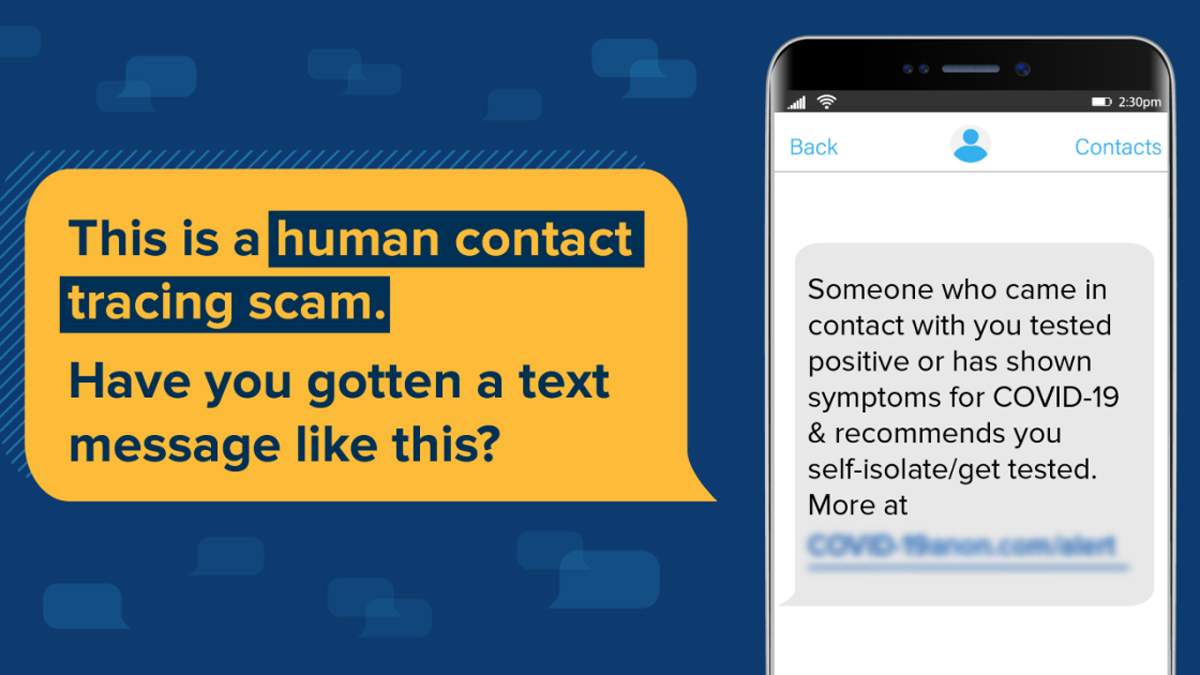

Fake Contact Tracing Scams

Speaking of calling victims, this is another method commonly carried out by scammers. This time around posing as Ministry of Health (MOH) or other government body representatives, with the ruse of conducting contract tracing during the ongoing pandemic.

In a shameless (and somewhat obvious) attempt, the scammer would ask victims to verify their identity via these calls by providing them with personal information. As you might have guessed, the information required will usually include banking information and login details.

As we’ve mentioned earlier, scammers ride on the wave of panic and fear. This is when victims are ripe for the picking, as this situation often blurs their ability to judge what’s fake and what is real. Let alone those who are unaware of such scams existing.

Fake World Health Organization (WHO) Scams

Assuming the identity of health-related organisations doesn’t end there. Some scammers would also disguise themselves as WHO representatives and have a different approach to deceive victims, according to recent reports.

Rather than using phone calls or SMS, these scammers would approach victims via email. The emails pose as newsletters or alerts by WHO, and would often contain malicious attachments disguised as certain documents.

When the attached document is accessed by a user, it will install remote-access Trojans or malware onto their devices that will be used to extract vital information. This is far more dangerous, as most users are unaware that such malicious activities are happening in the background until it is too late.

Alternatively, some emails would also provide a link to a bogus web page. While the page itself may be non-threatening, accessing it will trigger trackers or codes that will serve the same purpose as described earlier.

What You Can Do To Protect Yourself

For calls or SMS that are suspicious or fit the descriptions listed above, demand for a reference number to prove its legitimacy. You can also verify if the call or SMS is genuine by contacting the bank or organisation directly (via official website or call the number at the back of your bank cards) to verify if it’s genuine. The easiest and most common way to avoid this altogether is by rejecting the calls or ignoring the SMS, and blocking the suspicious phone numbers as well.

Be aware that both banks and organisations will never ask for a user’s login credentials or personal verification for their banking accounts and so on. Avoid providing any vital information which could be used to compromise your privacy and security.

If you’ve fallen victim to a scam, the most immediate step to take is to contact authorities – that includes the police, relevant enforcement agencies, and the bank that you’re registered with. Be sure to keep all records and documentations of the transactions, agreements, or other interactions with the perpetrators, which can be used as evidence – should you take action against them. Have your bank freeze your compromised credit cards or accounts in order to stop scammers from accessing them, and always keep track of every transaction made to ensure that no suspicious activities have taken place.

Scammers will continue to prey on victims and will always utilise the perfect situation to capitalise on this. While there is hope that COVID-19 will one day be stopped in this tracks, scammers will continue to roam the earth as long as there is money to be made.

Therefore, the best way to prevent ourselves from falling victim to their despicable schemes is to always be on alert and always aware of such possibilities. Stay vigilant and stay safe.

For further reading on security and fraud awareness, please visit CIMB’s support page via their official website with this link.

This article is brought to you by CIMB.

The post Scammers On The Prowl; How To Spot a Scam & What You Should Do appeared first on Lowyat.NET.

from Lowyat.NET https://ift.tt/3enxwuZ

Labels: Lowyat

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home