IRS Explains What Crypto Owners Must Know to File Taxes This Year

Kicking off this year’s tax filing season, the U.S. Internal Revenue Service (IRS) has published important tips for crypto owners to properly file their tax returns. This is the first time a cryptocurrency question has been included in the tax form. The IRS expects more than 150 million filers to reveal whether they acquired or disposed of any cryptocurrencies during the tax year.

Also read: Regulatory Roundup — New US Crypto Tax Bill, Central Banks Join Forces on Digital Currencies

IRS Kicks Off Tax Season

The IRS kicked off this year’s tax filing season last week with tips on how to file the 2019 tax returns. The deadline for filing and paying any tax owed is Wednesday, April 15. The agency expects more than 150 million individual tax returns to be filed.

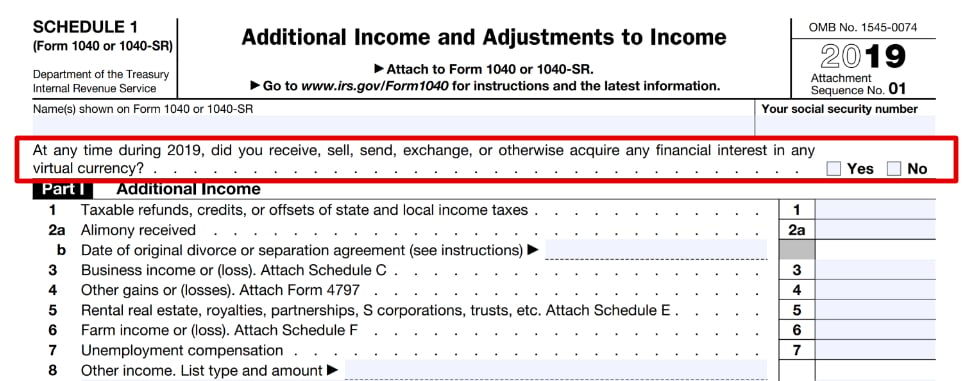

Among the changes to the 2019 Form 1040, the main U.S. tax form, is the addition of “an inquiry regarding the acquisition or disposition of any virtual currency,” the agency explained. The new crypto question appears on Form 1040’s Schedule 1, entitled “Additional Income and Adjustments to Income.”

“Virtual currency is an important addition to the 1040 this year,” IRS Commissioner Charles Rettig commented. “This emerging area is a priority for the IRS, and we want to help taxpayers understand their obligations involving virtual currency. We will also take steps to ensure fair enforcement of the tax laws for those who don’t follow the rules involving virtual currency.” The tax agency elaborated:

In 2019, taxpayers who engaged in a transaction involving virtual currency will need to file Schedule 1 … The Internal Revenue Code and regulations require taxpayers to maintain records that support the information provided on tax returns.

The IRS clarified that taxpayers must keep records of “receipts, sales, exchanges or other dispositions of virtual currency and the fair market value of the virtual currency.” It further noted that taxpayers who did not engage in any crypto transactions in 2019 do not have to file Schedule 1 for this purpose. However, if they are already filing Schedule 1 for other non-crypto purposes, then check the “no” box for the crypto question.

Reporting Crypto Income

According to the instructions for Schedule 1, a transaction involving cryptocurrency includes “The receipt or transfer of virtual currency for free (without providing any consideration), including from an airdrop or following a hard fork; an exchange of virtual currency for goods or services; a sale of virtual currency; and an exchange of virtual currency for other property, including for another virtual currency.”

The agency explained that if a taxpayer received any cryptocurrencies as compensation for services or disposed of any coins held for sale to customers in a trade or business, they must report the income as they would report other income of the same type. For example, W-2 wages are reported on line 1 of Form 1040 or 1040-SR. Some are reported on Schedule C. Form 8949 will help with figuring out capital gain or loss, which will then be reported on Schedule D of Form 1040.

IRS Publication 525, entitled “Taxable and Nontaxable Income,” states:

If your employer gives you virtual currency (such as bitcoin) as payment for your services, you must include the FMV [fair market value] of the currency in your income.

“The FMV of virtual currency paid as wages is subject to federal income tax withholding, Federal Insurance Contribution Act (FICA) tax, and Federal Unemployment Tax Act (FUTA) tax and must be reported on Form W-2,” the IRS emphasized.

The agency has provided two sets of guidance and FAQs on the tax treatment of cryptocurrencies. The first guidance was issued in 2014 and the second in October 2019. The latter focuses largely on hard forks and airdrops. News.Bitcoin.com has also published a list of useful tax tools to help crypto owners.

Crypto Is ‘An Important Focal Point for the IRS in 2020’

In its Progress Update for the fiscal year 2019 published in January, the IRS explained that cryptocurrency is among the new and emerging compliance areas requiring its attention. Along with enforcement activities, it is providing outreach and education in these areas.

In 2019, the tax agency sent letters to more than 10,000 crypto owners suspected of possibly failing to report their crypto transactions properly, it detailed, adding that “The letters explained the tax obligations associated with virtual currency and describe how taxpayers can correct past filing and reporting errors.” Noting that “Voluntarily compliant taxpayers deserve to know that noncompliant taxpayers are at risk,” the agency declared:

Virtual currency, also called cryptocurrency, will remain an important focal point for the IRS in 2020.

What do you think of the IRS’ crypto tax strategy? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and the IRS.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post IRS Explains What Crypto Owners Must Know to File Taxes This Year appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/37Rrr70

Labels: Bitcoin

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home